Personalized Financial Blueprints

Executed with precision with you at the center.

Financial Planning - The Aptus Blueprint

MEETING 1: DISCOVERY

Today is all about getting to know each other. We want to learn about your goals, including the “crazy ideas”, and what you believe could stand in your way. By the end of our hour today, we will know what our expectations for one another should we elect to proceed forward.

MEETING 2: ANALYSIS

Our second meeting is about educating you as to where you sit financially today and whether you are currently on track to reach your desired destination. We will also identify areas of concern and items that could be improved to better safeguard you against unforeseen financial land mines.

MEETING 3: THE BLUEPRINT

Today we show you how to make sure your financial arrow hits the bullseye. We show you how to minimize the impact of taxes, plan for inflation and interest rate changes, mitigate risk, and the appropriate blend of investments for your individual goals.

MEETING 4: IMPLEMENTATION

Today may be the most important day, as no plan achieves its objectives if it is not put into motion. While today is filled with the necessary minutia of paperwork, it is also a time where all details are reviewed again to ensure you are completely comfortable with each decision you are making about your future.

Aptus Wealth Advisory Portfolios

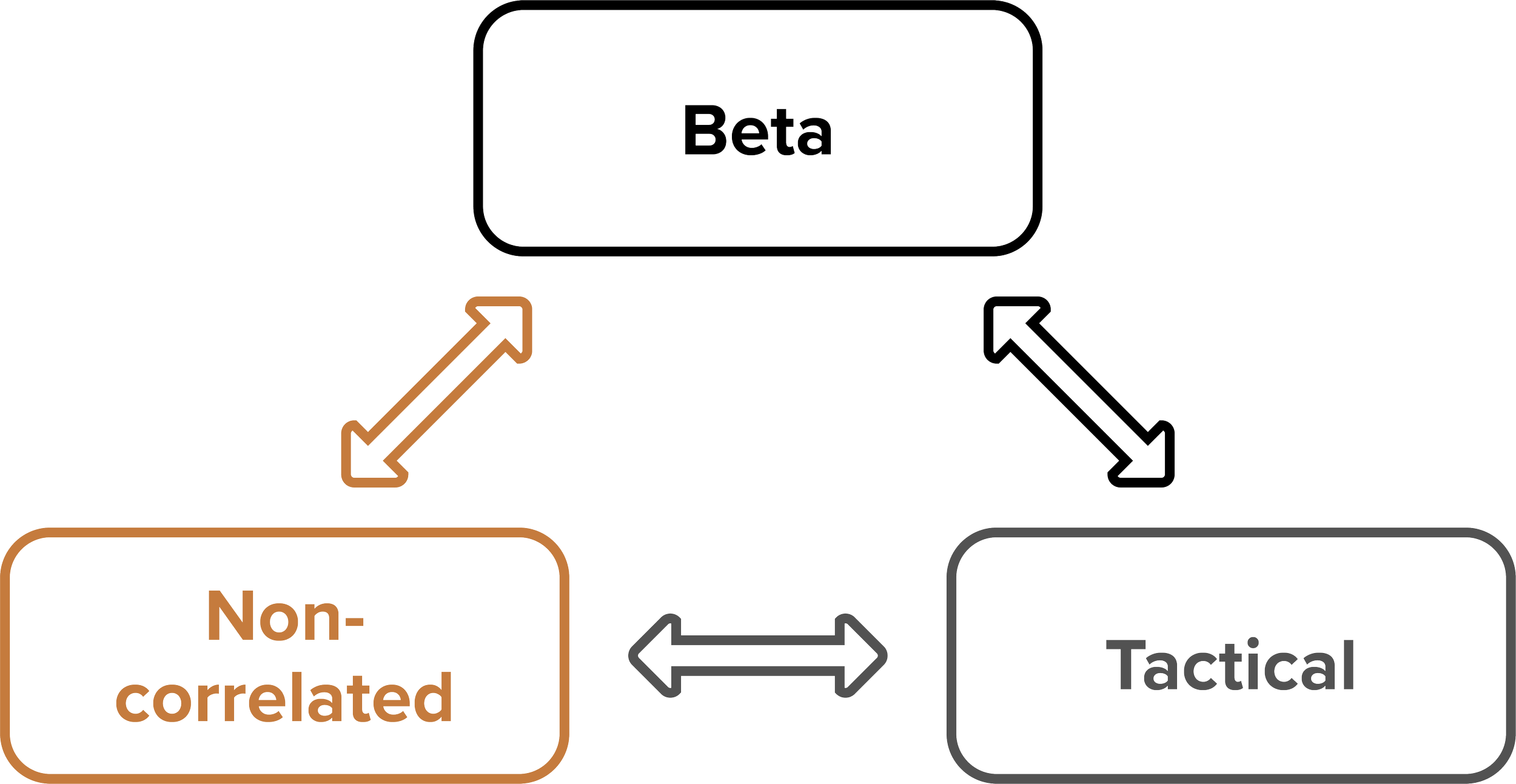

The main objective with the Aptus Wealth Advisory Portfolios is managing volatility and risk, with an assumption that by doing so, returns will follow suit. We construct the portfolios using 3 types of strategies: Beta, Tactical and Non-correlated.

Beta: These types of investments are also known as 'strategic' or 'traditional' investments. This will make up much of your portfolio, as we believe in an efficient market. Think of Exchange Traded Funds (ETFs), Mutual Funds or Stocks/Bonds to fill this portion. Your risk-based asset allocation will be upheld in this sleeve.

Tactical: This is a more "hands on' sleeve to your portfolio. Here is where you'll see more trading than your Beta sleeve. This is not us trying to time the market or day trade; we're making thematic and rotational changes as they occur.

Non-correlated: Hedge funds made liquid and available to the public without large minimums, that is how we fill this bucket. They are also known as Liquid Alternatives. These are normally mutual funds that use strategies you would see in a typical hedge fund, such as: Long/Short, Merger and Acquisition, Market Neutrality, Alternative Fixed Income and Arbitrage.

We Can Help